In September 2025, I made what I would consider the biggest leap of faith in my financial journey – I paid off my BDO Home loan with another loan. Please spare me the sermon. I know it’s never a good idea to pay a debt with another debt, but after doing the math, it made sense for me. To understand why this move wasn’t as crazy as it sounds, let’s rewind to 2022.

The Original Sin: Why I Chose BDO

In 2022, I availed ₱2,063,000.00 home loan from BDO, payable over 20 years with a 3-year fixed term. Why didn’t I avail a home loan from Pag-IBIG? When I compared Pag-IBIG’s 30-year plan with BDO’s 20-year plan, the numbers showed I’d be paying less with BDO, or so I thought. At the time, the shorter term seemed like the clear path to savings. Everything was okay until the 3-year fixed term ended in 2025.

The Interest Rate Shock

BDO’s initial interest rate of 5.500% per annum was manageable . But when the fixed term lapsed, the rate didn’t just inch up – it soared to 9.6560% per annum. To put that in perspective:

| LOAN TERM | INTEREST RATE | MONTHLY AMORTIZATION |

| Fixed Term (2022-2025) | 5.500% | ₱14,191.11 |

| Post-Fixed Term (2025-2026) | 9.5650% | ₱18,786.62 |

My payment jumped by a painful P4,595.51 overnight. But what made it even more shocking was the breakdown of that P18,786.62 monthly amortization. Out of ₱18,786.62, only 20% will go to the principal payment while a whopping 80% will go to the interest payment. To put that into numbers, let me break down my August 2025 payment:

- Principal: ₱3,381.22

- Interest: ₱15,405.40

- Monthly Amortization: ₱18,786.62

That’s a staggering ₱15,000 for interest payment every month. ₱15,000 MONTHLY INTEREST. This amount could cover so many essential expenses today. It just feels wrong and impractical. The bank was upfront about it, it was clearly stated in the loan contract. But reality hit hard when those numbers turned into actual payments.

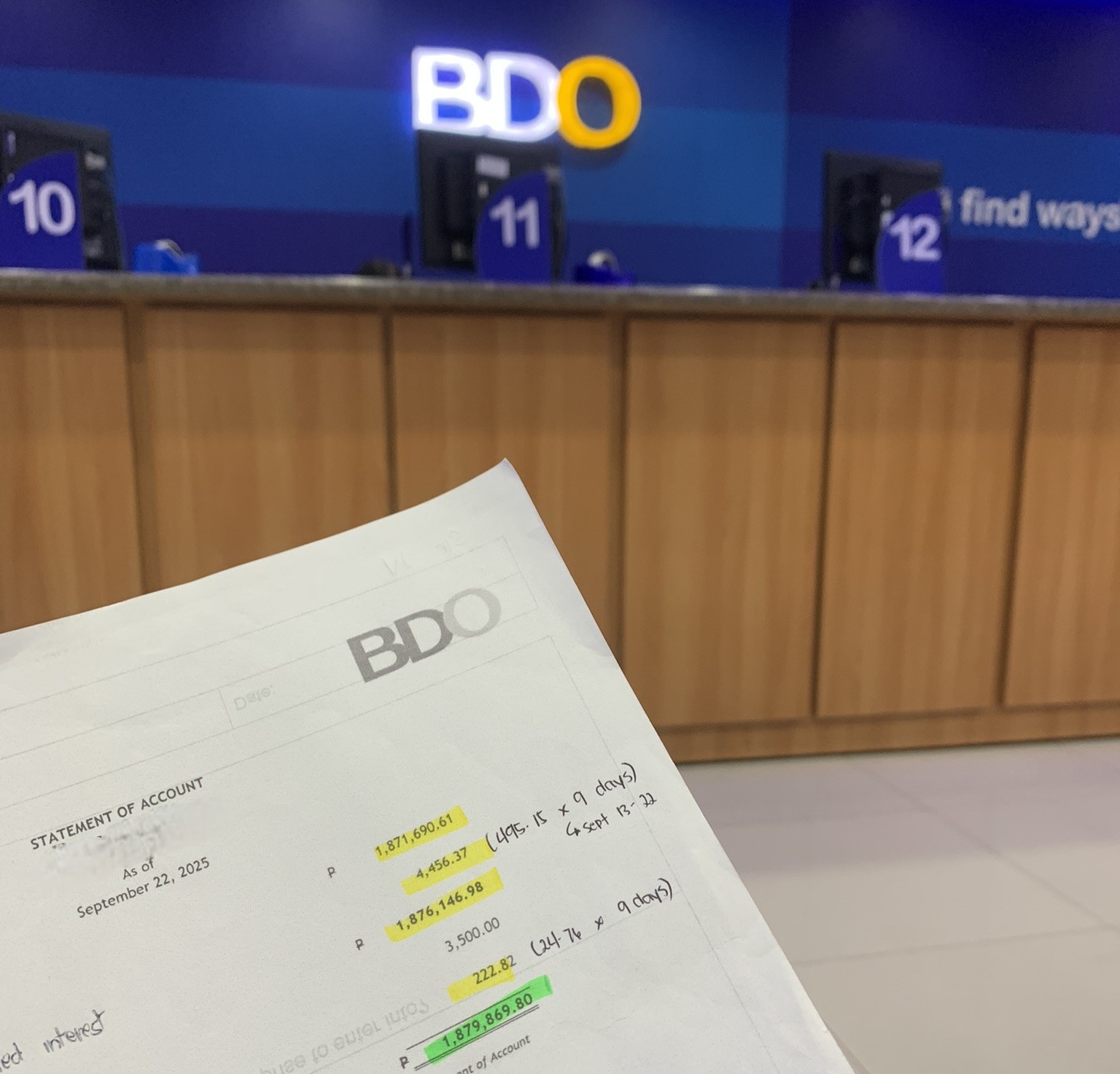

Let me share with you the repriced amortization schedule I requested from the bank. Take note that this is for one year only. They will review and recompute the amortization every loan anniversary date.

The Unseen Costs and Looming Risk

The bleeding didn’t stop there. As I review the repriced amortization table, I realized I was barely chipping away at the principal. This doesn’t even include the fact that the 9.6560% interest rate is only guaranteed for one year. It could still fluctuate over the next 17 years, depending on the bank’s repricing and prevailing market rates. Indeed, a terrifying uncertainty.

And that’s not even the end of it. I also had to shell out an additional ₱16,000 on average each year to cover the Fire Insurance and Mortgage Redemption Insurance (MRI) until the loan is fully paid.

It became crystal clear how little my hard-earned money was actually paying for my home. It is just enriching the bank, not building my wealth. I had to stop the bleeding. The new, high rate turned my home into a cash drain, and I knew I needed to find a way to escape this financial trap.

The Escape Plan: Trading Uncertainty for Savings

So, I started thinking of ways to pay off my home loan faster. These are the options that I considered:

- Refinance with a Pag-IBIG Loan: This option could give me a lower interest rate, but it would also reset my payment clock, meaning I’d end up paying interest for a much longer time.

- Use my credit card’s “convert to cash” feature: This option could enable me to pay part of my principal in advance, but credit card interest rates are much higher.

- Pay advance payments to the principal using my savings: This option seemed like the best because it would reduce both my monthly amortization and overall loan term. However, I’d still need to pay for a few more years, including the annual fire insurance and MRI premiums.

Just as I was weighing these options, my colleagues introduced me to Private Lending Institutions (PLIs). PLIs are accredited by the Department of Education to provide APDS loans to its teaching and non-teaching personnel. An APDS loan is a type of salary loan that uses the Automatic Payroll Deduction Scheme (APDS) for repayment. The accreditation is intended to protect DepEd employees from lending practices that are predatory, e.g. excessively high interest rates and other unfair terms. DepEd sets limits on interest rates and service charges to prevent usurious lending.I also learned that employees from State Universities and Colleges (SUCs), Local Universities and Colleges (LUCs), Commission on Higher Education (CHED), and Technical Education and Skills Development Authority (TESDA) personnel are also entitled to APDS loans.

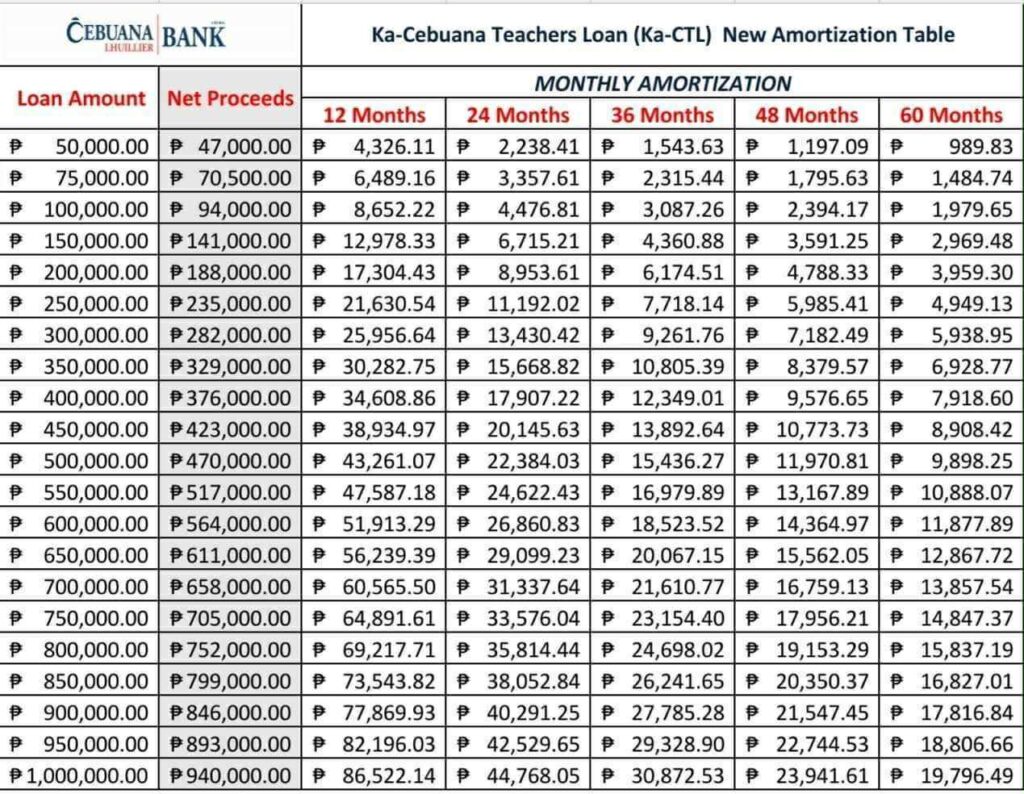

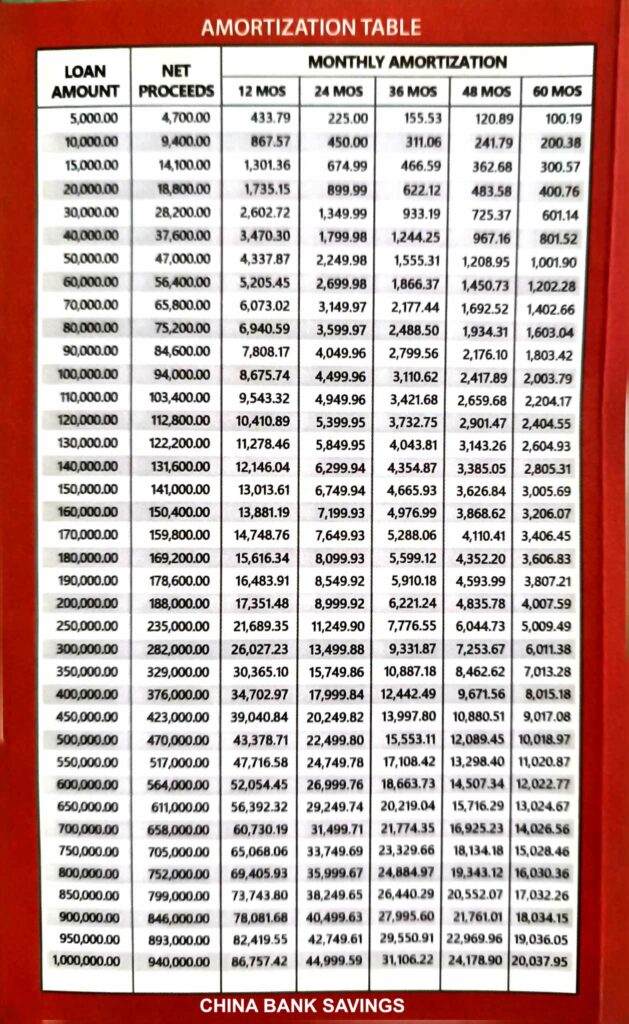

Upon learning this, I did my homework and inquired with two PLIs that offered the lowest interest rates – Cebuana Lhuiller Rural Bank, Inc. and China Bank Savings. Posted below are their loan tables as of October 2025.

The Math: Why the Debt Swap Made Sense

To fully settle my BDO home loan, I need to pay the remaining principal balance of ₱1,871,690.61, plus the processing fee and daily charges. Since PLIs can only lend up to ₱1,000,000 each, I will need to take out two separate loans to cover the amount.

Under DepEd Department Order No. 05, s. 2018, DepEd personnel must maintain a minimum net take-home pay of ₱5,000 after all deductions – including loan payments, insurance premiums, and other financial obligations, in order to avail APDS loan. This ensures that teachers still have enough for their personal needs after paying their dues. Because of this rule, I will be able to avail a total of ₱1,900,000 in loans. However, with the bank charges, deductions and all, the total net proceed is ₱1,786,000.00 only. Which means, I still need to raise the remaining fund to completely settle my BDO obligation.

Combining the monthly installments from both PLIs, my new monthly payment is ₱37,830.64, payable in 5 years (60 months).

| CEBUANA LHUILLER RURAL BANK | CHINA BANK SAVINGS | TOTAL | |

|---|---|---|---|

| Loan Amount | ₱1,000,000.00 | ₱900,000.00 | ₱1,900,000.00 |

| Net Proceeds | ₱940,000 | ₱846,000.00 | ₱1,786,000.00 |

| Monthly Installment | ₱19,796.49 | ₱18,034.15 | ₱37,830.64 |

| Loan Term | 5 years (60 months) | 5 years (60 months) | 5 years (60 months) |

| Total Interest | ₱187,789.40 | ₱182,049.00 | ₱369,838.40 |

The Cost of Staying with the BDO Loan

To help me make an informed decision, I calculated the potential long-term cost of sticking with my BDO home loan. I used the repriced monthly amortization for 2025 and conservatively assumed that the effective interest rate would remain constant until the end of the loan term.

| Monthly Amortization | ₱18,786.62 |

| Remaining Loan Term | x 204 months |

| Total Payment | ₱3,832,470.48 |

| Less Principal Balance | – ₱1,871,690.61 |

| Total Interest | ₱1,960,779.87 |

The figures above show that the total interest to be incurred for the remaining 17 years is ₱1,960,779.87. This does not even cover the mandatory insurance costs. The bank also requires me to secure and maintain both credit life insurance (Mortgage Redemption Insurance or MRI) and fire insurance in favor of the bank until the loan is fully paid. This premium averages ₱16,000 annually.

Factoring that in:

| MRI Premium (2025) | ₱9,027.17 |

| Fire Insurance Premium (2025) | ₱7,342.25 |

| Remaining Loan Term | x 17 years |

| Total Insurance Premium | ₱278,280.14 |

The insurance premium will vary based on the outstanding loan balance and property’s insured value. Let me just round this off to ₱16,000 per year payable by 17 years, which brings the total insurance cost to ₱272,000.00. To get a clearer picture of my total home loan cost with BDO, I added everything up, as shown in the table below:

| ITEM | COST |

| Total Interest (17 years; 2025-2042) | ₱1,960,779.87 |

| Total Insurance Premium (17 years; 2025-2042) | + ₱272,000.00 |

| Total Interest and Insurance Cost for 17 years | ₱2,232,779.87 |

| Total Interest Paid (3-year fixed term; 2022-2025) | + ₱326,360.75 |

| Total Insurance Premium Paid (3-year fixed term; 2022-2025) | + ₱48,991.42 |

| Total Interest and Insurance Cost for 20 years | ₱2,608,132.04 |

| BDO Home Loan Principal | + ₱2,063,000.00 |

| Total Loan Cost | ₱4,671,132.04 |

The computation revealed a sobering truth. The true cost of staying with the current loan for 17 years is ₱2,232,779.87. Adding the total interest and insurance premium I have already paid in the past 3-year fixed term and the principal amount I borrowed from the bank, the total loan cost amounts to ₱4,671,132.04. This clearly shows that total interest and insurance charges alone exceed the principal amount I actually borrowed. Any appreciation in the value of the house I bought would have gone straight to the bank.

This staggering cost confirmed the urgency of switching to another option. Despite the required two-loan strategy and the need to cover a small funding gap, refinancing through the PLIs is the best and most practical solution among all the options. By making this switch, I will achieve a substantial savings of ₱1,862,941.47 (as shown in the comparison table below) over the life of the loan. My primary goal is not just to find a cheaper rate, but to secure a lower, fixed-rate for a shorter loan term. This decision allows me to stop the bleeding and regain control of my financial future.

| BDO Home Loan Total Cost | APDS Loan Total Cost |

| ₱2,232,779.87 or ₱131,339.99/year | ₱369,838.40 or ₱73,967.68/year |

| TOTAL SAVINGS IN INTEREST AND INSURANCE PAYMENT AFTER THE REFINANCING |

| ₱1,862,941.47 |

Analyzing the Trade-Offs

| BDO Home Loan | APDS Loan (Combined) | |

| Loan Amount | ₱1,871,690.61 | ₱1,900,000.00 |

| Monthly Amortization | ₱18,786.62 | ₱37,830.64 |

| Loan Term | 17 years | 5 years |

| Collateral | House Title | None |

| Total Interest | ₱1,960,779.87 | ₱369,838.40 |

| Total Insurance Premium | ₱272,000.00 | None |

Requirements for the APDS Loan

The application process for the APDS loan was surprisingly easy. I contacted the loan agents through their Facebook Messenger account. They quickly provided a list of essential documents, which are standard for securing a salary loan under the APDS program. They asked me to submit the following requirements:

- 3 consecutive latest original payslips

- Photocopy of 2 valid IDs (back to back) with 3 specimen signatures, preferably PRC and DepEd IDs

- Photocopy of Permanent Appointment (back to back)

- Fully filled up application form

- GSIS loan records, if any

These requirements are necessary for both PLIs to verify my employment status, professional licensing, and, most importantly, my capacity to repay the loan in compliance with the DepEd’s net take home pay regulation. I submitted all these requirements to the loan agents via Facebook Messenger. Within a day or two, the loan agents emailed my school’s loan verifier, with me copied on the message, to confirm my application details. Once the application was verified and approved, I received the loan proceeds in less than three days. The efficiency of the process was a pleasant surprise. Thanks to this quick process, I was able to settle my financial obligations with BDO right on time. If you need a comprehensive walkthrough, here is the step-by-step guide on the BDO Home Loan Full Payment process.

If you wish to inquire about or apply for the APDS loan, you can contact the loan agents through their contact information:

- Cebuana Lhuillier Rural Bank, Inc. – Joevanie Verde at jcverde@pjlhuillier.com

- China Bank Savings (APD Imus Main Branch) – Marjorie Samalio at mrsamalio.cbs@chinabank.ph

Here are comprehensive tips for anyone considering refinancing a home loan or availing an APDS loan, including the key points you requested:

Essential Tips for Refinancing and Availing APDS Loans

Switching a major financial obligation like a home loan is a huge decision. Here are essential tips to guide you through the refinancing or APDS loan process:

- Confirm the eligibility of PLIs. Check the latest DepEd Memorandum or circular from your respective Regional/Division Office to confirm that the PLI is currently accredited by the DepEd under the Automatic Payroll Deduction System (APDS). Using an unaccredited lender means losing the protection and regulatory oversight the APDS program provides.

- Know your numbers. Before applying, calculate your absolute maximum capacity. Remember that DepEd requires a minimum NTHP of ₱5,000.00. You must work backward from this minimum to see how much loan amortization your salary can bear. Compare PLIs and bank’s interest rates and terms to see who offers the lowest Effective Interest Rate (EIR), as this shows the true cost of the loan.

- Prepare your documents. Have all required documents (Payslip, IDs, Permanent Appointment Certificate, etc.) ready and clearly scanned to ensure a quick verification process.

- Communicate clearly. Utilize the direct channels provided by the loan agents (e.g., dedicated email or professional chat apps) to ensure quick correspondence and to receive confirmation emails, especially those involving your school’s verifier.

- Borrow responsibly. Loans should only be considered when absolutely necessary and when they qualify as “good debt.” Good debt is an investment that can increase your net worth or save you money in the long run (like a mortgage or, in this case, refinancing to escape a crushing high rate). Avoid borrowing for luxury items or expenses that depreciate immediately.

A Financial Leap of Faith

Why do I consider this move to be the biggest leap of faith in my financial journey? Because I maxed out the loanable amount my salary could take. Meaning, my monthly net take-home pay is now only ₱5,000. I am not even sure if this amount will be enough to cover for my monthly expenses. Was I careless? Was this step too extreme and unnecessary? Indeed, some have already suggested it was a wrong move. But I know my capacity. I live a simple and frugal life, I am confident I can live within my means, and I am committed to finding ways to earn extra. Most importantly, I know my Heavenly Father will provide for my needs. That is why I call this my biggest leap of faith so far.

To be honest, I felt very nervous when I received the loan proceeds. But that nervousness isn’t rooted in fear, it’s mixed with excitement. I’m excited to see how God’s wonders will unfold. For the very first time, I am intentionally stepping into a place of complete reliance on God because I literally have nothing left of my salary. I am excited to see firsthand how His math works, just as He fed the multitude with only five loaves and two fishes. This is my chance to fully witness His power and His provision, just as He continues to feed the birds that neither plant nor harvest.

I’m sharing this not to boast, but to remind everyone reading: you don’t have to worry. God always has our best interests at heart. Even now, with a heart overflowing with gratitude, I can’t help but whisper, “Heavenly Father, thank You.”

We all face moments when faith is the only thing that keeps us moving forward. What was your biggest financial leap of faith, and how did God sustain you along the way? Feel free to share them in the comments, your story might inspire someone who’s facing their own leap right now.

Disclosure on Financial Computations:

The calculations and cost estimates in this blog are based on my personal, simplified math and are used only to inform my own decision. Please remember that I am not a financial professional, so these figures are estimates only and may not be perfectly accurate. Always rely on the official Disclosure Statement from your lending institutions before acting.